New York State Estate Tax Exemption 2024. The irs and the new york state department of taxation recently announced the 2024 exemption and exclusion amounts related to federal estate tax, federal. Taxpayers who make gifts of “present interest” can exclude the first $18,000 given.

The new york exemption amount for 2023 is $6.58 million. It is indexed for inflation with 2010 as the base year for this.

The Nys Estate Tax Exemption For 2024 Was Increased To $6.94 Million, Up From $6.58 Million In 2023.

According to the bill, sales tax certificates of exemption will be issued for data center contracts entered into before july 1.

We Posted The Basic Exclusion Amount For Dates Of Death On Or After January 1, 2024, Through December 31, 2024.

$6,940,000 estate tax exemption for individuals dying after january 1, 2024.

The New York State Estate Tax Exclusion Amount Will Increase To $6,940,000 In 2024 (From $6,580,000 In 2023).

Images References :

Source: www.dochub.com

Source: www.dochub.com

Tax exempt form ny Fill out & sign online DocHub, The current estate tax exemption is $12,060,000 and double that amount for married couples. The new york estate tax exemption equivalent is now $6.94 million and is phased out for new york taxable estates valued between 100% and 105% of the exemption amount,.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, $6,940,000 estate tax exemption for individuals dying after january 1, 2024. Taxpayers who make gifts of “present interest” can exclude the first $18,000 given.

Source: yanafeldmanlaw.com

Source: yanafeldmanlaw.com

New York Estate Tax A MustKnow Guide Updated Jan 2024, The pause in the tax breaks will run from. Even if a deceased person’s estate is not large enough to owe federal estate tax, individuals may still owe an estate tax to the state of new york.

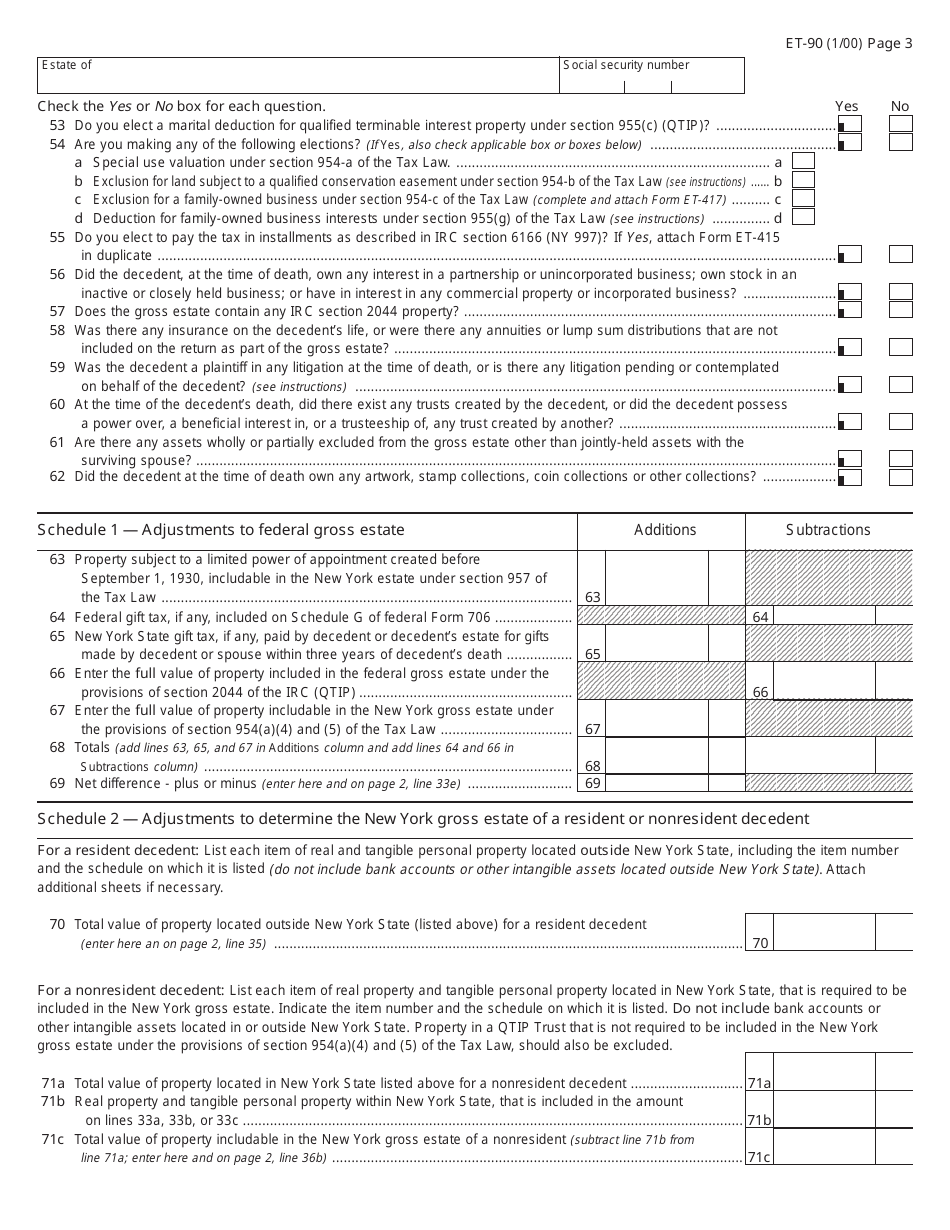

Source: www.templateroller.com

Source: www.templateroller.com

Form ET90 Download Printable PDF or Fill Online New York State Estate, The new york estate tax exemption equivalent is now $6.94 million and is phased out for new york taxable estates valued between 100% and 105% of the exemption amount,. The state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new york estate tax.

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, The new york estate tax threshold is $6.94 million in 2024 and $6.58 million in 2023. The pause in the tax breaks will run from.

Source: www.dochub.com

Source: www.dochub.com

Tax exemption form Fill out & sign online DocHub, We posted the basic exclusion amount for dates of death on or after january 1, 2024, through december 31, 2024. Note that new york has not yet released the new york state estate tax exemption amount for 2024;

Source: www.clearestate.com

Source: www.clearestate.com

New York Estate Tax Exemption 2022, The state has set a $6.94 million estate tax exemption for 2024 (up from $6.58 million in 2023), meaning if the decedent’s estate exceeds that amount, the estate is required to file a new york estate tax. As of january 1, 2024, the new york state estate tax exclusion amount increased from $6,580,000 to $6,940,000.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, Taxpayers who make gifts of “present interest” can exclude the first $18,000 given. New york has state inheritance taxes that differ from federal estate taxes.

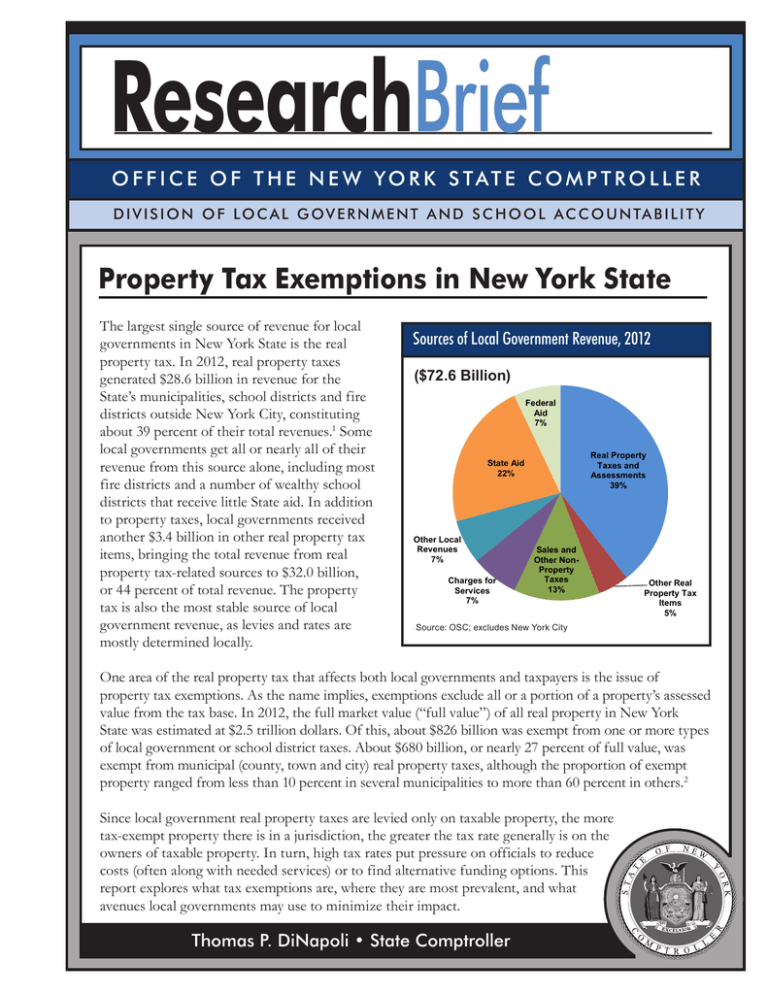

Source: studylib.net

Source: studylib.net

Property Tax Exemptions in New York State, The pause in the tax breaks will run from. Note that new york has not yet released the new york state estate tax exemption amount for 2024;

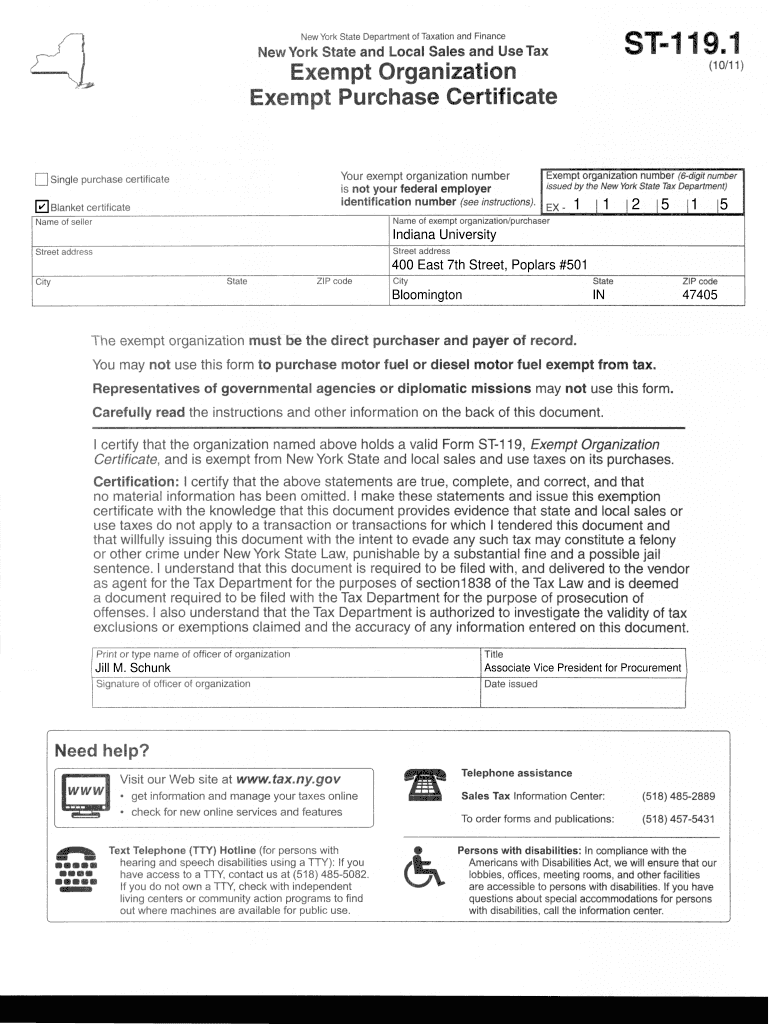

Source: www.exemptform.com

Source: www.exemptform.com

New York State Tax Exempt Form St 119, The new york exemption amount for 2023 is $6.58 million. The new york estate tax is a cliff tax, such that if the.

So Even If Your Estate Isn't.

Many of its alterations are set to expire after 2025.

The Pause In The Tax Breaks Will Run From.

The current estate tax exemption is $12,060,000 and double that amount for married couples.