Medical Deduction 2024 Over 65. If you are both, you get double the additional. It discusses what expenses, and.

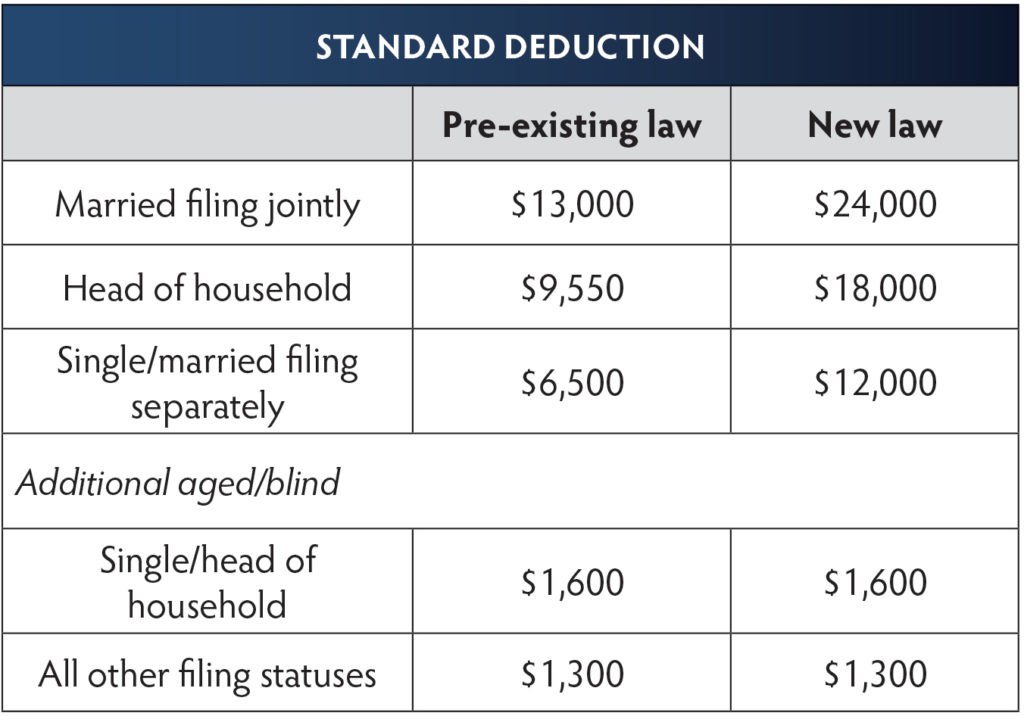

How much is the additional standard deduction? If you are 65 or older or blind, you can claim an additional standard deduction.

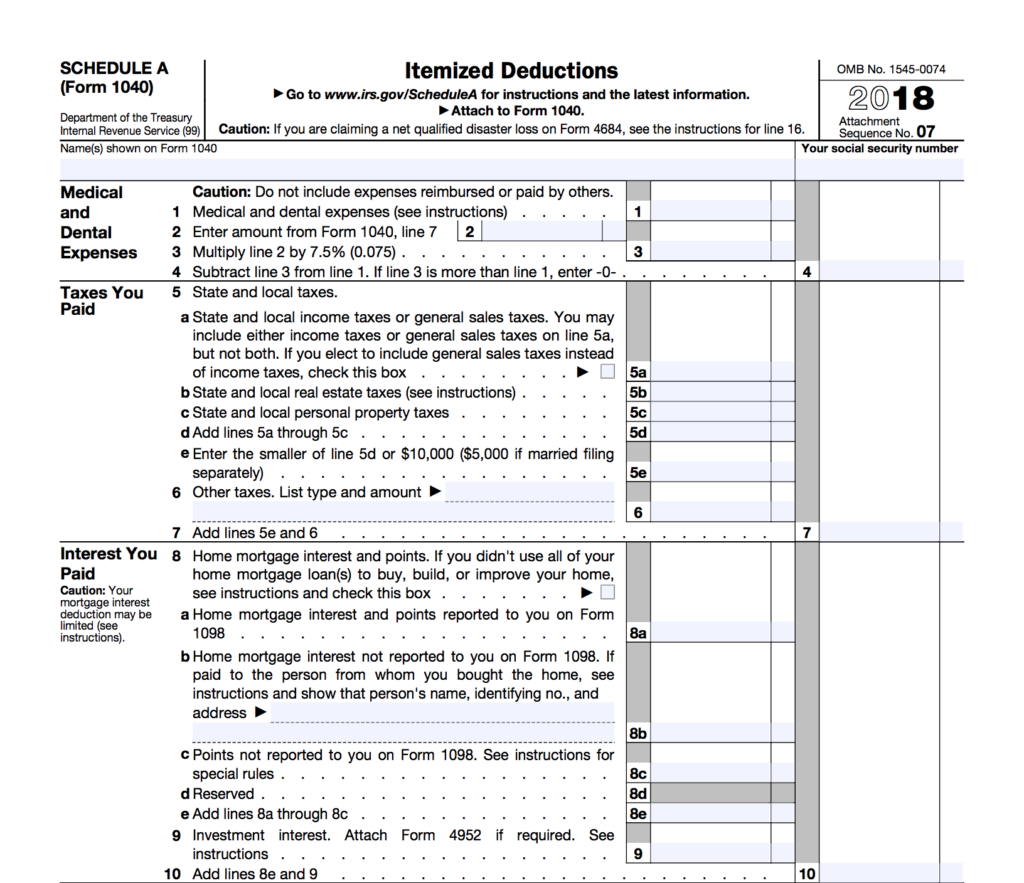

How To Claim A Tax Deduction For Medical Expenses In 2024 You Might Be Able To Deduct Qualified Medical Expenses That Are More Than 7.5% Of Your Adjusted Gross Income.

For taxpayers who are married and filing jointly, the standard deduction for.

If You Itemize Your Deductions For A Taxable Year On Schedule A (Form 1040), Itemized Deductions, You May Be Able To Deduct The Medical And Dental.

To deduct medical expenses on your tax return, you need to itemize deductions rather than claim the standard deduction.

If You Are Both, You Get Double The Additional.

Images References :

Source: www.marca.com

Source: www.marca.com

Medical expenses deduction How much can you actually deduct? Marca, How to claim a tax deduction for medical expenses in 2024 you might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income. Medical and dental expenses can add up quickly.

Source: financegourmet.com

Source: financegourmet.com

IRS Standard Deduction 2021 Finance Gourmet, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental. How to claim a tax deduction for medical expenses in 2024 you might be able to deduct qualified medical expenses that are more than 7.5% of your adjusted gross income.

Source: standard-deduction.com

Source: standard-deduction.com

Standard Deduction 2020 Age 65 Standard Deduction 2021, If you are both, you get double the additional. For taxpayers who are married and filing jointly, the standard deduction for.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

Can I Deduct Medical Expenses? Ramsey, The 2024 standard deduction was raised to $14,600. How much is the additional standard deduction?

The IRS Just Announced 2023 Tax Changes!, The rc4065 is for persons with medical expenses and their supporting family members. To deduct medical expenses on your tax return, you need to itemize deductions rather than claim the standard deduction.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, How much is the additional standard deduction? Single or married filing separately — $13,850 ($15,350 if they’re at least.

Source: standard-deduction.com

Source: standard-deduction.com

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021, Taxpayers get a higher standard deduction when they turn 65 or are blind. Standard deduction and itemized deduction.

Source: standard-deduction.com

Source: standard-deduction.com

Standard Deduction 2020 Mfj Over 65 Standard Deduction 2021, This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Her total standard deduction amount.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

CPF Allocation Rates Here's How They Change As You Grow Older And How, Higher standard deduction for age (65 or older). For the tax year 2023, which you’ll file in 2024, the standard deduction limits are as follows:

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

Don’t Miss This Opportunity for a Medical Deduction in 2020 CPA, Taxpayers get a higher standard deduction when they turn 65 or are blind. So, if your agi is $50,000, you could deduct eligible expenses exceeding $5,000.

Amount In Excess Of Standard Deduction For Child, If Child’s Income Included On Parent’s Federal Return 316.690 Foreign Income Taxes 316.693 Subtraction For Medical Expenses.

If you are both, you get double the additional.

For Taxpayers Who Are Married And Filing Jointly, The Standard Deduction For.

Taxpayers 65 and older and those who are blind can claim an additional standard deduction.